- Torsten Sløk, the chief economist of Apollo, thinks stagflation is coming for the US.

- That’s a dreaded scenario where the economy slows while inflation remains high.

- Sløk pointed to thebond market, which appears to be pricing in higher inflation and weaker growth.

A top Wall Street economist says the bond market is sending a dire warning about what could be ahead for the US economy.

Torsten Sløk, the chief economist of Apollo Global Management, said he believes the recent spike inbond yieldsis signaling that the economy could be headed for a period ofstagflation.

It’s an economic scenario that hobbled the US economy in the 1970s, and it entails a slowdown in economic growth while inflation remains stubbornly high.

It’s widely considered to be even harder for monetary policymakers to tackle than a typical recession, as central bank officials can’t lower interest rates to boost growth out of fear of stoking more inflation.

“This is essentiallystagflation,” Sløk said about what yields are implying about the US economic outlook “By definition, tariffs mean higher inflation, and it means lower growth,” he told CNBC on Friday.

Bond yields have been rising this year, but the move higher has accelerated in recent weeks. It has been driven partly by concerns about theUS budget deficit, and partly by fears that President Donald Trump’s tariffs will raise prices, leading to higherinterest ratesin the economy.

The yield on the10-year US Treasuryspiked as high as 4.61% this week, up 63 basis points from lows in early April.

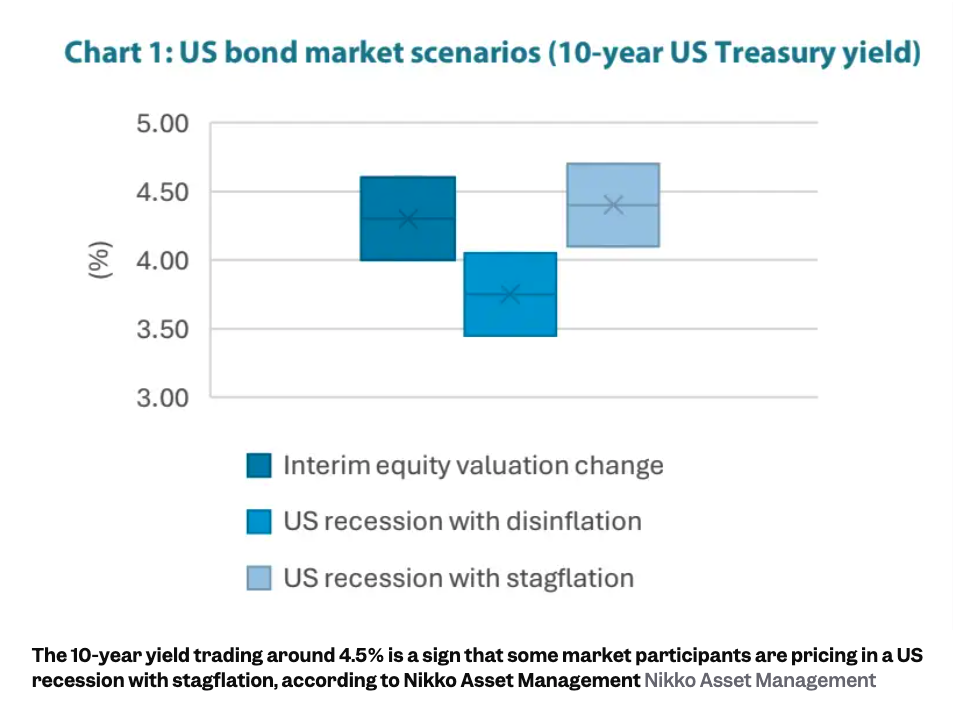

The 10-year yield is trading within the range that implies some market participants are pricing in a recession with a stagflation scenario, Naomi Fink, chief global strategist at Nikko Asset Management, wrote in a note this week.

The yield on the2-year US Treasurywas about 3.96% on Friday, down 28 basis points from the start of the year. That can be a sign that investors expect the economy to weaken over the near term, which would prompt lower interest rates.

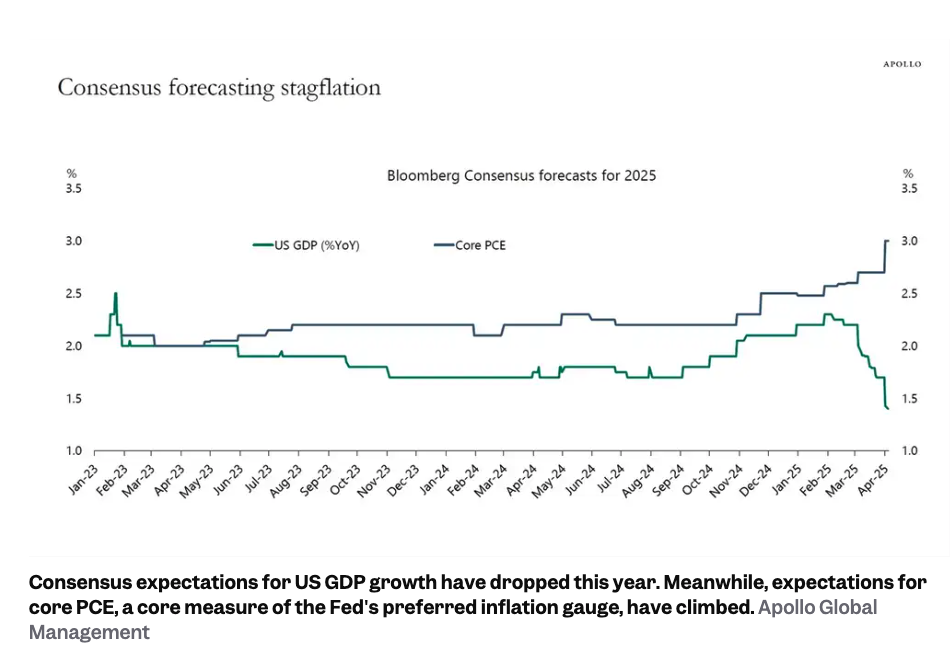

Consensus expectations for USeconomic growthhave already started to trend downward, while inflation expectations have climbed, Sløk said in a note to clients this month.

Stagflation concernshave been creeping back into the mix of Wall Street commentary as traders turn their attention away from trade deals and eye the longer-run impact of tariffs.

JPMorgan bossJamie Dimonsaid he believed the economy was still at risk of stagflation this week, though he wasn’t necessarily forecasting the scenario.

“I think global fiscal deficits are inflationary. I think the remilitarization of the world is inflationary. The restructuring of trade is inflationary,” he said, speaking to Bloomberg on Thursday.

Nobel laureatePaul Krugmansaid that he believed price increases stemming from tariffs could come “within weeks,” and that the economy was poised to slow.

“The inflationary impact of tariffs is coming,” the top economist said in a televisedinterviewthis week. “Certainly an economic slowdown. Certainly a bump up in the inflation rate. It’s stagflation. Maybe it’s stagflation-lite, but we’re definitely heading for some kind of stagflation.”