For decades, 401(k)s have been a staple of US retirement savings, designed to sit as untouched nest eggs that workers build up for their golden years. However, that idea is starting to crack, as more and more Americans are tapping into the assets — which were worth a collective$8.9 trillionin 2024— earlier and more often, sometimes just to get by.

Lifelines

According to a recentBloomberg report, early withdrawals from 401(k)s to cover urgent financial needs are now running15% to 20%above the historical norm, per data from Empower, the second-largest retirement plan provider in the US. These so-called “hardship withdrawals” are granted when people are facing “immediate and heavy” expenses, including medical bills, tuition, or payments to avoid eviction or foreclosure.

Even though these withdrawals come with income tax — and often a10%penalty — more of us are turning to the plans as last-resort financial lifelines.

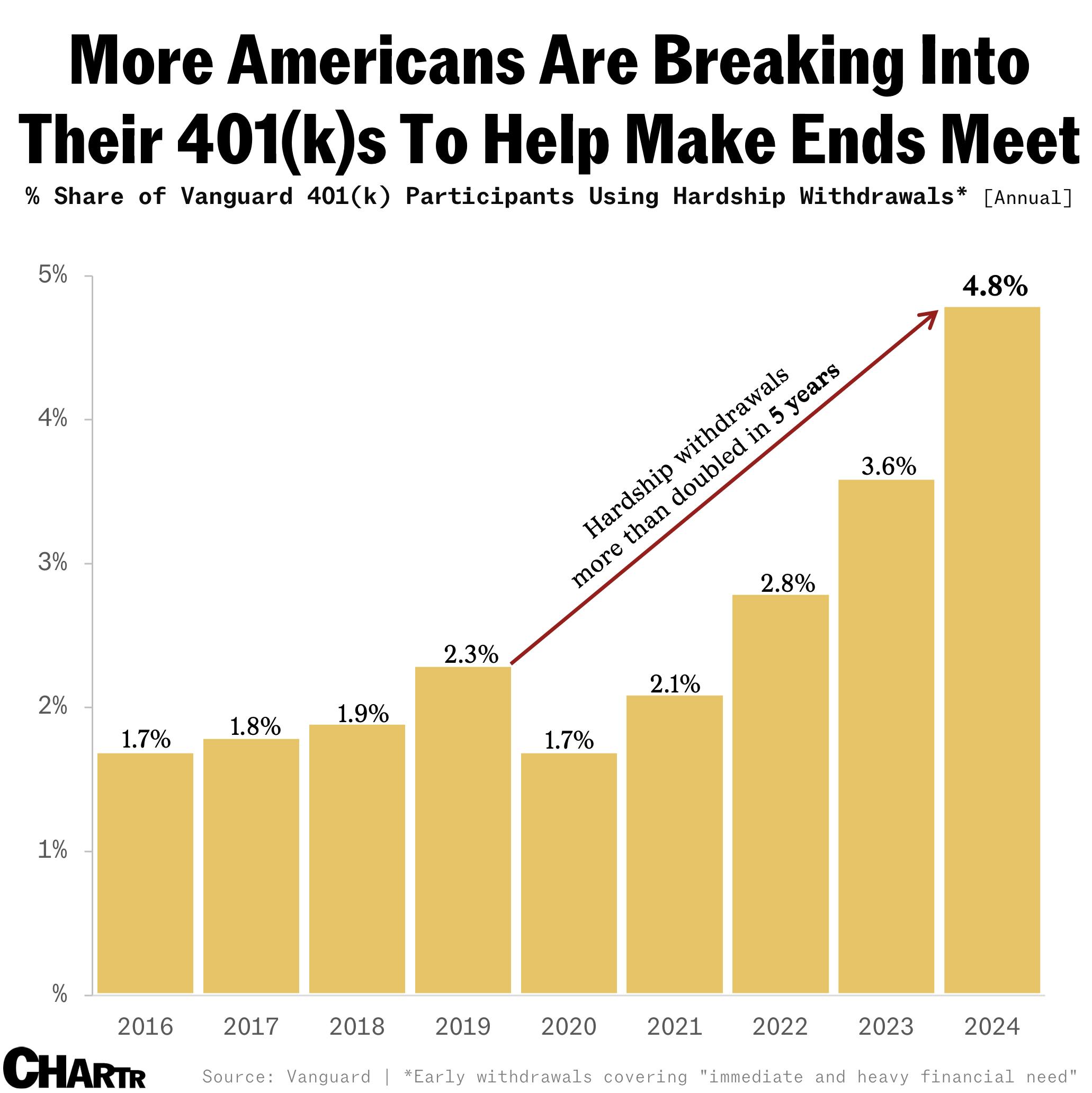

According to Vanguard Group, arecord 4.8%of its 401(k) account holders made hardship withdrawalslast year—more than doublethe 2.3% share seen in 2019, after a decade of holding steady at ~2%.

So,what changed?

Part of the rise stems from easier access. Since 2018, Congress has steadilyrelaxed the rulesaround hardship withdrawals. At the same time, the rise ofauto-enrollmentin 401(k)s brought more workers (especially lower-income ones) into retirement plans, giving them more savings to draw on at a pinch.

But the recent uptick points to growing financial strain, too. In 2023,39%of Vanguard’s hardship withdrawals were used toavoidforeclosure or eviction, up from 31% just two years earlier. Nearlyone-thirdof all hardship withdrawals were forless than $1,000— suggesting many households are struggling to cover even small expenses.

That aligns with broader economic trends: in February, the share of Americans who said they could cover a $2,000 emergency expensedroppedto a record low, according to the New York Fed. At the same time, healthcare costs, rising prices, and the wider economy prevail as America’s top worriesin 2025.

Dataset

| Year | % Share of Vanguard 401(k) Participants Using Hardship Withdrawals |

|---|---|

2016 |

1.70% |

2017 |

1.80% |

2018 |

1.90% |

2019 |

2.30% |

2020 |

1.70% |

2021 |

2.10% |

2022 |

2.80% |

2023 |

3.60% |

2024 |

4.80% |

Data sources

*Early withdrawals covering “immediate and heavy financial need”